How To- Maximize Your Credit Score

In order to achieve the great success you want in life you are going to need credit. A high credit score will save you money throughout your life and allow you to make your money work for you. Only the poor work for their money. You want your money to work for you.

This post assumes you have already started to establish your credit. Please see “How To- Establish Credit” for information on how to get started on your credit journey. If you are repairing credit you have damaged by poor choices, please see “How To- Pay Off Credit Cards”. You can use the following information in this post in conjunction with either of those posts, or on its own.

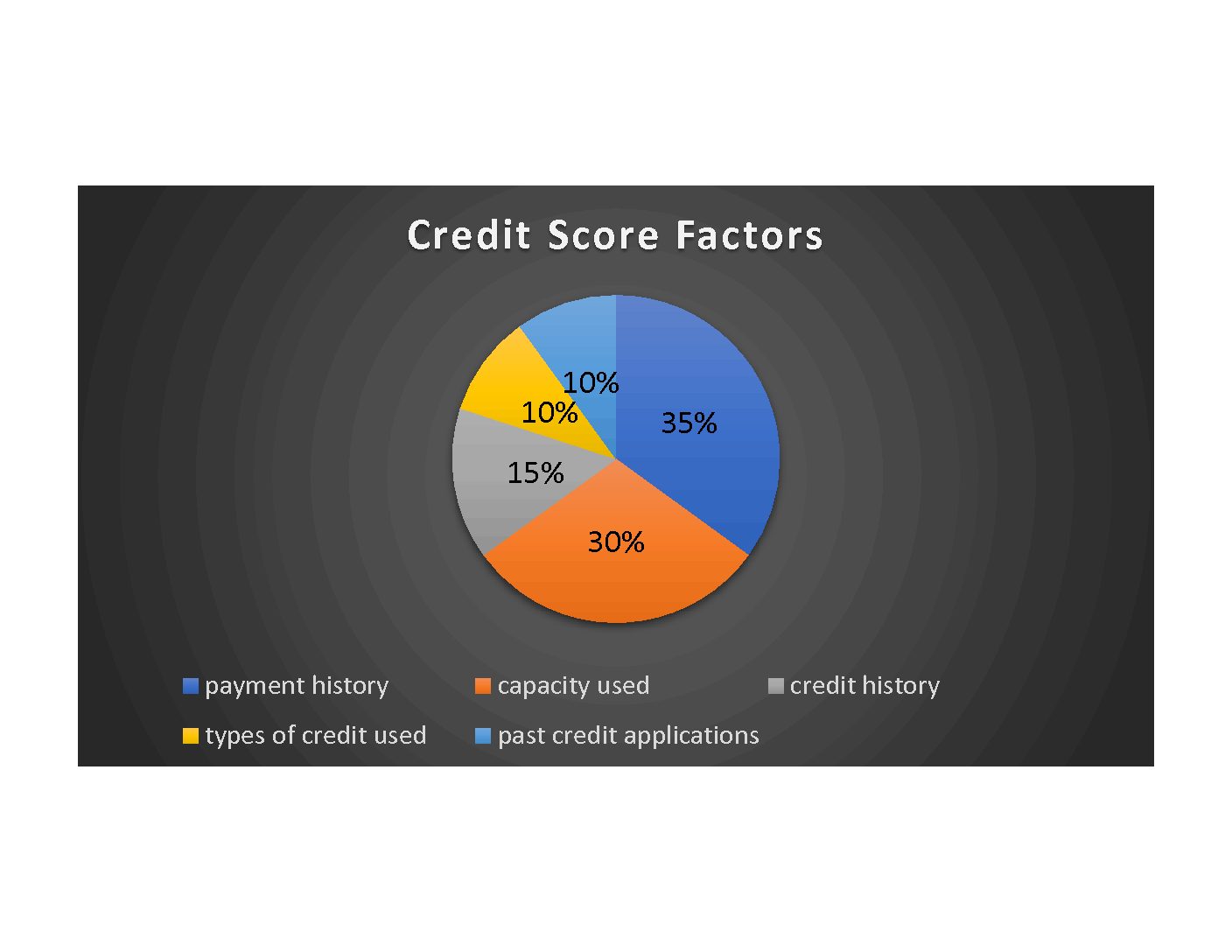

Your credit score is made up primarily of five components:

payment history

capacity used

credit history

types of credit used

past applications

These components are weighted and calculated to give you a credit score.

This score will be between 300 and 850. Every lender has a different scale, but generally anything above 740 is considered excellent and anything below 580 is poor. Fair is generally 580-669 and Good is generally 670-739.

You can find your credit score on the website of almost any credit card you currently have. Your bank may also have this information available. Your credit score can and will change often. Some websites will also offer a “what if” calculator that can show you potential credit score changes based on a number of life events- paying down balances, opening a new credit line, applying for a mortgage, etc.

Once you know your credit score, you can figure out how to increase it. Do you have high balances? Pay down your balances (see “How To- Pay Off Your Credit Cards” for some tips). Do you only have one or two types of credit used in the past? Apply for a different type of credit. This may be a personal loan if you only have credit cards, or a car loan, mortgage, etc.

payment history 35%

This is how often you made your payments on time in the past. This information can stay on your report up to seven years. This area will also include any amounts you did not pay, perhaps to a business, creditor, landlord, etc. If a lender sees only an occasional late payment on your report, they will not be concerned. But, chronic lateness and/or defaults will cost you dearly. Pay on time and challenge any incorrect information on your credit report.

capacity used 30%

This is how much of your available credit you are currently using. Ideally, you will pay your credit cards in full each month. If this is not possible you should have no more than a 20% balance rolling over from one month to the next on your credit cards. Anything more will count against your credit score. The credit card company will report the balance as of the statement end date. An easy way to keep reported balances low is to pay your credit cards before the due date or even on a weekly or bi-weekly basis.

credit history 15%

Your credit history is how long you have had credit. How long have you had your oldest credit line? What is the average age of all of your credit lines combined? Keeping your first credit card open, even if you only use it every six months for a small purchase, will maximize your credit history score.

types of credit used 10%

There are various types of credit available- credit cards, unsecured loans (meaning you borrowed cash, but not for a physical asset), secured loans (meaning you have physical property, like a car, attached to the loan), mortgages, installment loans (student loans, auto loans, furniture purchases), and rental data. Maintain a diverse credit portfolio. You do not have to have all six types, but try to have more than one or two.

past applications 10%

Every time you apply for new credit, the potential creditor will appear on your credit report. This is both to protect you (so you can see who is accessing your credit report) and so the creditors can see if you are potentially getting into too much debt. Checking your credit score does not count against this part of the calculation.

Action Steps:

1. Check your credit score.

2. See what area(s) of your credit score could use some attention. Contest anything that does not look right.

3. Make a plan to strengthen any weak areas.

4. Regularly check your credit score to see how you are doing. Some credit cards will alert you if any red flags are detected by their monitoring software.

5. Revise your plan as needed.

Leave a Reply